Elevate Approach

ALIGN YOUR MONEY WITH YOUR MISSION

You’ve built something real—an income, a career, a life. But as your goals grow, so does the cost of guessing.

The Elevate Approach is a modern planning system that brings structure, strategy, and expert follow-through—so you can protect what you’ve built and turn it into long-term freedom, security, and purpose. It’s how hands-on professionals get clarity and control to make smart financial decisions—across work, family, and every season of life.

Who It’s For:

You’ve worked hard to build a strong income, career, or business—but it doesn’t always feel like it’s building the life you want.

You’re ready for a system that brings clarity and structure—so decisions feel less like guesswork and more like progress.

You want real guidance—from someone who knows the terrain, and a process that fits your life and keeps you moving forward.

Why It Matters:

Every dollar you earn fuels two lives—the one you’re living, and the independent life you’re building for tomorrow.

Your income feels strong now—but unless it’s working harder than inflation, your future lifestyle quietly shrinks.

When income feels strong, it’s easy to drift—but without intention, today’s comfort can quietly delay the freedom you actually want.

Key Planning Areas:

Cash Flow & Tax Strategy: Keep more of what you earn—and know where it goes.

Insurance & Protection: Be ready for the unexpected—with coverage that fits your world.

Investment Planning: Grow your money with clarity and intention—not guesswork or trends.

Work-Life & Independence: Plan for freedom on your timeline—not someone else’s retirement script.

Legacy & Estate Planning: Protect your people and your wishes—with less confusion, more confidence.

What You’ll Get:

Every dollar you earn serves two lives. We’ll design a cash flow and tax strategy that supports your lifestyle now—and secures your independence later.

Financial planning is aligning your money with what matters most. You’ll get a clear, personalized roadmap that connects your goals, values, and income into one strategy.

Smart decisions shouldn’t wait for a crisis. With our ongoing guidance, you’ll have a decision-making system that keeps you ahead of life’s biggest changes.

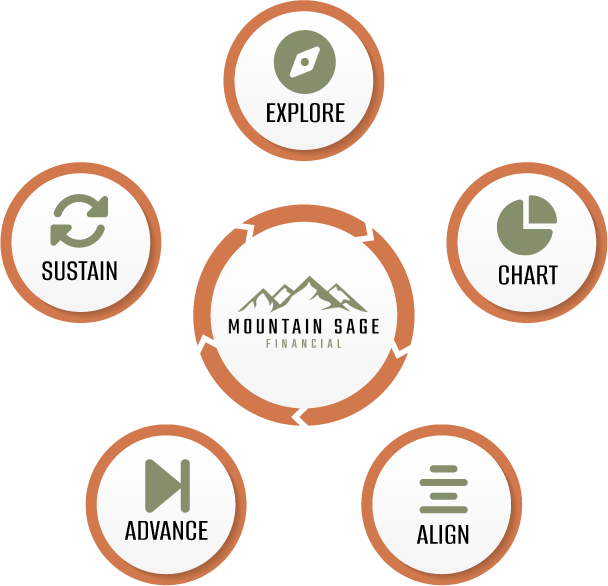

Our Process:

Establish, Educate, Execute

The Foundations Approach is built around three simple but powerful steps: Establish, Educate, and Execute. It’s a clear, efficient process—designed to be completed in just one or two focused meetings—so you can make a smart decision and move forward with confidence.

1. Explore – Define Priorities & Get the Full Picture

What It’s About: We begin by understanding your life, goals, and financial picture—what’s working, what’s not, and where you want to go.

What We Do Together: Through structured conversations and custom diagnostic tools, we uncover opportunities, concerns, and the building blocks of your plan.

Key Actions & Outcomes: You walk away with a clear understanding of where you stand—and what’s possible with the right strategy.

2. Chart – Structuring Your Financial Strategy

What It’s About: Like a doctor reviewing lab work, we analyze your financial data—then build a custom plan around your goals, income, taxes, and long-term security.

What We Do Together: This is advisor-led—we do the deep work of planning and strategy development, so what comes next is clear and actionable.

Key Actions & Outcomes: You receive a structured, personalized financial plan that serves as the foundation for every decision ahead.

3. Align – Choosing Your Path Forward

What It’s About: With your strategy in hand, this step is about alignment—making sure it fits your real life and adjusting what’s needed before we move forward.

What We Do Together: Like walking a job site with an architect, we step through your plan—clarifying options and adjusting the design before we break ground.

Key Actions & Outcomes: You move forward with clarity and commitment—knowing your direction makes sense and supports what matters most.

4. Advance – Turning Strategy Into Action

What It’s About: Financial planning only works if it gets implemented. This step is about coordinated action—with expert support to guide next steps.

What We Do Together: From account setup to insurance coordination, we walk through your action steps—so you’re never doing it alone.

Key Actions & Outcomes: Your financial plan is put into motion—with systems in place and behaviors aligned for long-term success.

5. Sustain – Ongoing Support to Adapt & Refine

What It’s About: A great plan isn’t static—it grows with you. We monitor your progress, adjust to life changes, and help you keep momentum.

What We Do Together: We review progress regularly, adjust your strategy as needed, and keep things on track through proactive conversations.

Key Actions & Outcomes: A long-term partnership and a financial system that adapts with you—so your money keeps working, no matter what life brings next.

What You Walk Away With:

I. A modern planning system that gives you clarity and control to make confident financial decisions—through every season of life, across your career, family, and future goals.

II. Clarity today, and a plan that adapts with tomorrow

III. A structured system for confident decisions—now and through life’s changes

IV. A trusted guide in your corner for whatever life throws next